Estados & Reportes

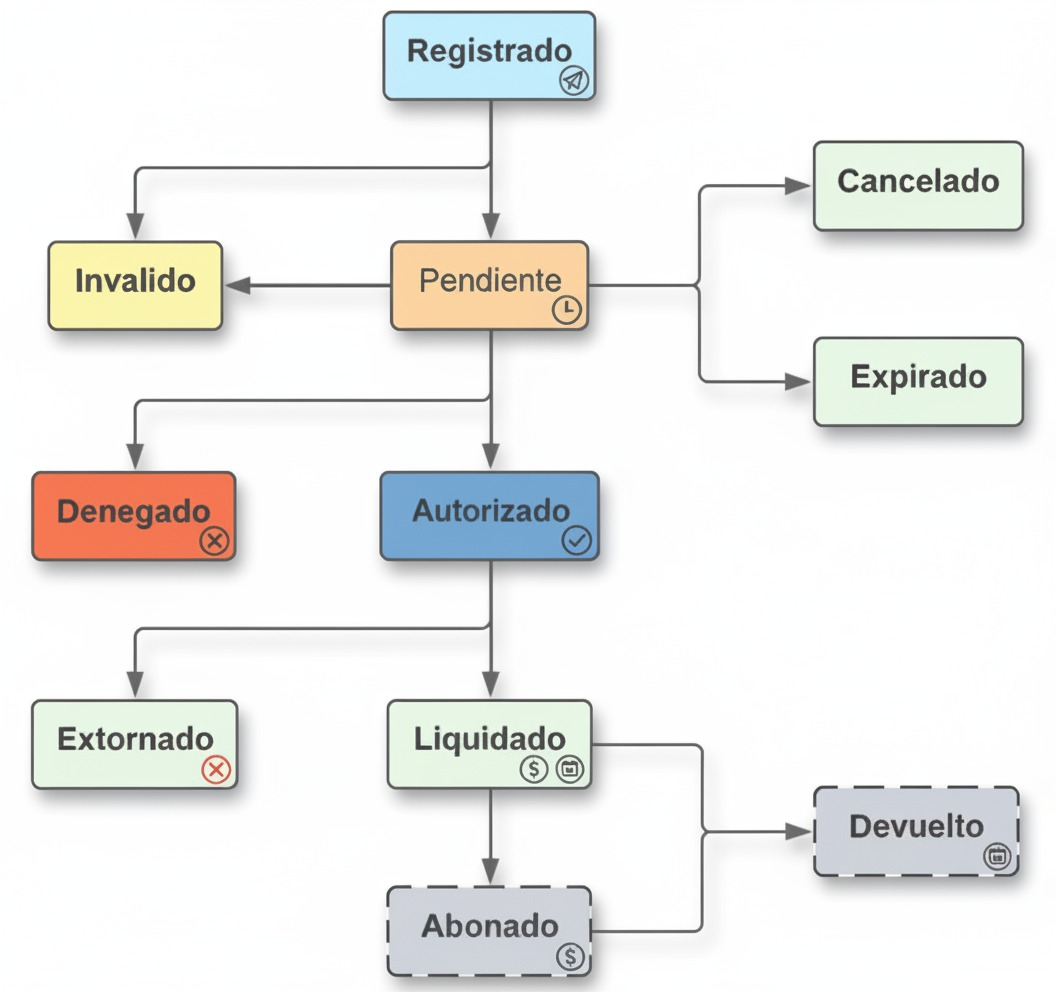

Transaction Statuses (Operational Definition)

They represent the lifecycle of each operation/transaction:

Pending (asynchronous, may expire) → Authorized → Settled / Voided

Non-successful statuses (Canceled, Expired, Invalid, Declined) are grouped in KPIs and filters as:

Successful = Authorized, Settled, Voided

Unsuccessful = All others

Status Definitions

Status | Description |

|---|---|

Pending | Operation created without a final response. Common in asynchronous methods (wallets / bank transfer). If no response is received within the TTL, it becomes Expired. |

Authorized | Approved by brand/processor. Funds are reserved and can be captured or settled. |

Settled | Included in the settlement process. Funds may not yet be deposited to the merchant (depending on acquirer calendar). Often grouped by batch or settlement file. |

Voided | Reversed after being authorized (refund or reversal, depending on acquirer policies and timeframes). |

Declined | Rejected by issuer / brand / internal rules (insufficient funds, incorrect PIN, etc.). |

Invalid | Failed internal risk validations or processing error. |

Canceled | Canceled by the customer or system before completion. |

Expired | TTL elapsed without response (no financial impact). |

Paid Out (Coming soon) | Indicates that funds have been credited to the merchant. |

Refunded (Coming soon) | Indicates that funds have been returned to the customer after settlement. |

Simplified Flow (Asynchronous Methods)

Created → Pending → Authorized / Declined / Expired → Settled

Pending automatically expires if the wallet does not respond within the configured time window.

What Does “Settled” Mean in the Dashboard?

Definition: The transaction has been captured/cleared by the acquirer or processor and included in a merchant payout.

Data Source: Determined via reconciliation processes using settlement files/batches from the processor (T+1, T+2, etc. depending on contract).

Where to See It: In the grid as Last Status = SETTLED. In Detail View, the Reconciliation and Authorization Analysis sections may include references to batch/file ID (if exposed by the integration).

Relation to “Authorized”: Every settled operation was previously authorized, but not every authorized one is settled (voids, cancellations, or later declines may apply).

Voids: An Administrator may request voids depending on policies/time windows. A post-settlement void appears as a negative entry in the corresponding payout period.

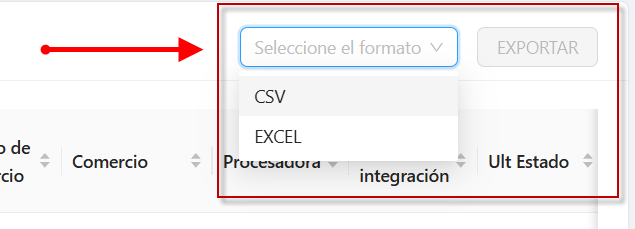

Exporting Reports (CSV / XLS)

Common Fields in Report Files

Date / Time, Channel, Payment Method, Brand, Status

Operation ID, Transaction ID, Order Number, Merchant

Amount, Currency, Authorization Code (if applicable)

Reason / Decline Message, ECI / VCI (if applicable)

Settlement Fields (if available): Settlement Date / Cutoff, Batch/File ID, Net Amount, Fees

CSV or XLS?

Format | Recommended Use |

|---|---|

CSV | Ideal for system integrations or external data ingestion. |

XLS | Best for Excel analysis, pivot tables, and charts. |

All reports are stored in Metrix and remain available for 48 hours.

Additional Information

Quick Glossary

Term | Definition |

|---|---|

Operation | A group that contains one or more transaction attempts (for the same order). |

Transaction | A single attempt using a specific method, with its own status. |

Integration Method | API / SDK / FLEX (depending on channel/technology). |

BIN / Last PAN | First digits of issuer / last masked digits of the card. |

ECI / VCI | Transaction security indicators (if applicable). |

TTL | Time-to-live of a pending operation (expires if no response). |

Support | For incidents or questions, contact your internal support channel. Always include date range, Operation/Transaction ID, and Merchant. |

Soporte: Para incidencias o dudas, contacta a tu canal interno de soporte. Incluye siempre rango de fechas, Id Operación/Transacción y comercio. Contact